Un gestor de fondos sobre lo que realmente se necesita: educación y trabajo duro

Tres desafíos, una mentalidad: conozcan a Giorgi Durgarian, un trader que conquistó Sweet Pepper tres veces

Esa es una gran pregunta. De hecho, mi carrera comenzó como asesor de ventas en una empresa de trading, aunque no era muy bueno en ventas, para ser honesto. Después de un mes, mi jefe me dijo lo mismo y dijo que 9 de cada 10 personas me habrían dejado ir. No estoy seguro de por qué me dio otra oportunidad, ¡pero afortunadamente, no en ventas!Acababa de graduarme de la universidad y, como muchos otros, simplemente estaba buscando trabajo. Lo que realmente me gustó fue el entorno: muchos buenos traders trabajando en la misma oficina, compartiendo ideas y conocimientos. Aceleró enormemente mi curva de aprendizaje. Tuve la suerte de estar en ese entorno.Así es como comenzó mi experiencia. Pasé innumerables noches en la oficina estudiando y absorbiendo el conocimiento de los traders que me rodeaban. Eventualmente, me convertí en un trader de la compañía y, a lo largo de los años, encontré mi camino hasta ser jefe de operaciones en nuestra empresa de corretaje y gestión de activos.

Esa es una pregunta difícil, pero creo que la respuesta se remonta a hace mucho tiempo. Probablemente tenía alrededor de 14 años cuando comencé a entender cómo funciona realmente el mundo: de dónde viene el dinero y qué se necesita para vivir bien. Siempre he estado obsesionado con las matemáticas y los números, y me di cuenta desde el principio de que nadie se hace rico solo con un salario.Nunca quise una vida tradicional de 9 a 5, pero también sabía que tendría que trabajar increíblemente duro para construir algo diferente. Como muchas personas, estuve expuesto por primera vez al trading a través de películas. En ese entonces no había tanta información en línea como la que hay ahora.El trading me atrajo porque está impulsado por los números, y esa siempre ha sido mi pasión. Elegí el trading porque sabía que tenía el potencial de proporcionar una vida radicalmente diferente, no solo éxito financiero, sino también libertad.

Para ser honesto, no considero que mi posición sea "única" ni creo que haya logrado nada importante todavía. Mis metas aún están muy por delante.Pero uno de los mayores conceptos erróneos que veo entre los traders minoristas es la idea de "dinero rápido". Muchas personas persiguen ganancias rápidas sin comprender la gestión de riesgos. No quieren pasar años aprendiendo, probando sus ideas, desarrollando resiliencia psicológica. Piensan que operar se trata solo de aprender una estrategia y hacer clic en "comprar" y "vender".En realidad, el trading es una habilidad que, si se domina adecuadamente, puede generar riqueza y libertad. Ganar del 3 al 6% mensual de manera constante, no todos los meses, pero de manera constante a lo largo del tiempo, puede convertirse en una fortuna. Pero la estabilidad es clave. Una vez que alcanzas ese nivel, gestionar el capital se convierte en una posibilidad real. Aún así, es importante comprender que gestionar grandes cantidades de capital es mucho más exigente de lo que la mayoría de la gente piensa, y pocos están realmente preparados para ello.

Estaba siguiendo a un grupo dirigido por Wladislav y vi que se compartían muchos certificados de pago. Eso llamó mi atención. Investigué más y encontré su empresa en ForexPropReviews, donde tenía un ranking alto.También hablé con varias personas del grupo de Wladislav para conocer sus experiencias, lo cual fue realmente importante para mí. Después de eso, decidí probar un desafío. ¡Ahora llevo con ustedes más de siete meses!

Mi experiencia ha sido genial hasta ahora. No he tenido problemas. Sé que algunas personas en ese grupo mencionaron baneos de cuentas debido a actividad sospechosa desde su dirección IP o violaciones de copy trading. Por supuesto, no es agradable escuchar ese tipo de cosas. Pero solo puedo hablar por mí mismo.

Nunca me han rechazado un pago ni ningún problema con el Equipo de Riesgos. Siempre he seguido las reglas y pautas con mucho cuidado. Espero que nuestra relación continúe de esta manera, a largo plazo y mutuamente rentable.

Con el tiempo, he desarrollado muchas estrategias y enfoques. Como la mayoría de la gente, comencé con indicadores, ¡pero rápidamente me di cuenta de que generalmente solo conducen a arruinar tu cuenta!

Desde mi perspectiva, solo hay un motor real del movimiento del mercado: el dinero. Y el dinero proviene de los grandes jugadores: bancos, fondos de cobertura, traders institucionales. Entonces, la idea era simple (al menos en teoría): encontrar una manera de rastrearlos y seguirlos, porque ir en contra de ellos es lo peor que puedes hacer.

Eso me llevó al análisis de volumen y opciones. Hoy en día, estas son mis principales herramientas. Utilizo datos de volumen y opciones de CME, ya que alrededor del 70% del volumen se transmite a través de opciones y futuros. También utilizo análisis de clústers y perfiles de volumen para identificar zonas de alto interés e identificar entradas precisas. Por supuesto, eso es solo una parte — el análisis de volumen es un campo grande con muchas capas.El beneficio clave de este enfoque es que se adapta al mercado. Las estrategias a menudo se rompen cuando cambian las condiciones. El análisis de volumen, por el contrario, es más una metodología, y esa flexibilidad ha sido invaluable.

Sí, son completamente diferentes.Con prop trading, estás sujeto a ciertas reglas: no operar durante las noticias, límites de apalancamiento, reglas de stop-loss, etc. En la gestión de fondos, esas restricciones no existen, aunque, por supuesto, aún debes gestionar el riesgo con mucha precisión.

Pero la gran diferencia es la distribución de las ganancias. Con las empresas prop, obtienes el 80% de las ganancias. En la gestión de fondos, a menudo es solo del 10 al 25%, según el capital y los términos. Y los pagos se realizan trimestralmente o incluso anualmente, lo que es una desventaja en comparación con el prop trading.

Dicho esto, ambos caminos ofrecen grandes oportunidades para que un trader obtenga capital. Y en ambos, la clave del éxito a largo plazo es la misma: gestión precisa del riesgo y control emocional. Esa parte es muy difícil, pero absolutamente esencial.

A través de la experiencia, especialmente en los tiempos difíciles. Y aceptando una de las verdades más difíciles: debes admitir cuándo estás equivocado y salir de tu operación, ya sea mediante stop-loss o manualmente.

Eso es increíblemente difícil, especialmente para principiantes. Tienden a ampliar los stop loss, aumentar las posiciones no rentables y, finalmente, perder sus cuentas.

Pero las pérdidas, incluso perder meses, son parte del juego. Cuanto antes lo acepte un trader, antes comenzará a hacer un progreso real. Puedes equivocarte muchas veces, lo que importa es tus objetivos a largo plazo. Después de 100, 200 o 300 operaciones, si tu sistema funciona, será rentable. La paciencia y la consistencia lo son todo.

Mi mayor consejo: invierte en ti mismo. La educación lo es todo.

Un buen mentor puede ahorrarte años de prueba y error. Su experiencia vale mucho más que el costo de la tutoría, y ciertamente más que el costo de aprender a través de tus propios errores.

Pero encontrar un mentor verdaderamente bueno es difícil, especialmente hoy en día, cuando el mercado está inundado de autoproclamados "gurús". E incluso con un mentor, no es una solución mágica. Todavía tienes que trabajar increíblemente duro para tener éxito. Nadie lo hará por ti, es un hecho.

La historia de Giorgi Durgarian es un recordatorio de que el éxito constante en el trading no es mágico: se construye transacción por transacción, regla por regla, desafío por desafío.

Ya sea que recién estás comenzando tu primer desafío Sweet Pepper o estás buscando subir de nivel después de algunos tropiezos, sus ideas ofrecen una nueva perspectiva.

En SpiceProp, nos enorgullece apoyar a traders como Giorgi que combinan talento con perseverancia y que tratan cada desafío como una prueba y una oportunidad.

¿Quieres ser el siguiente? Tu desafío está esperando.

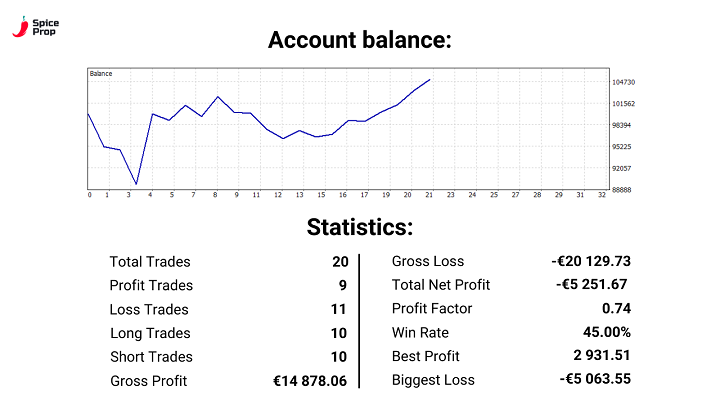

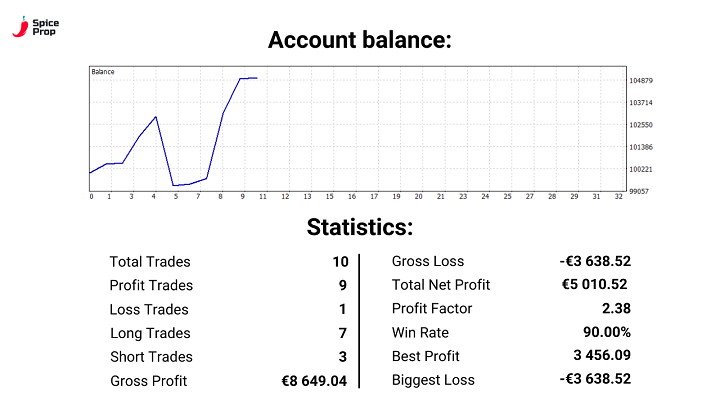

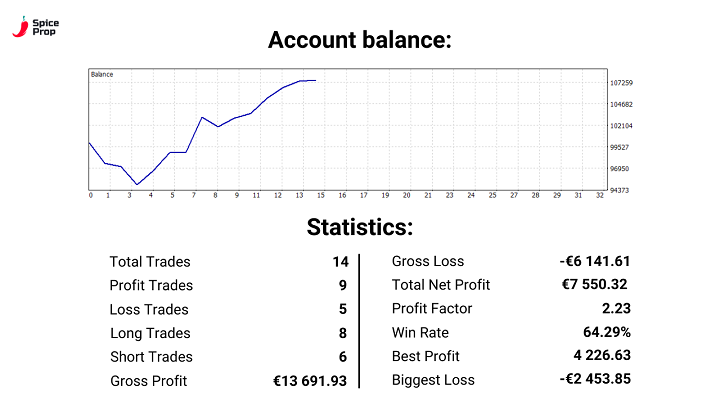

18/10/2024 - 06/11/2024

Etapa 1. Datos estadísticos. Sweet Pepper 100K. Trader: Giorgi Durgarian (Georgia).

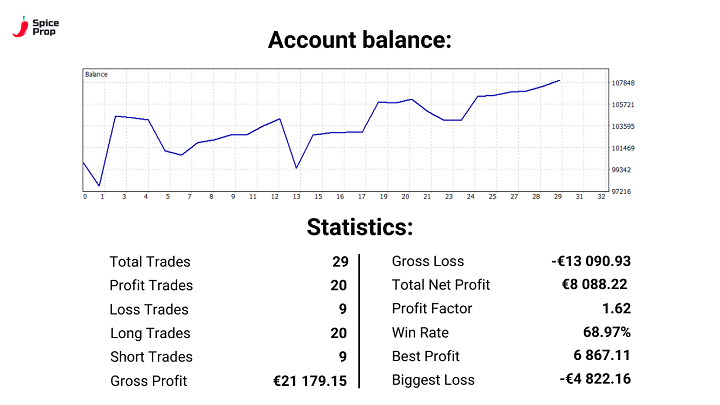

Etapa 2. Datos estadísticos. Sweet Pepper 100K. Trader: Giorgi Durgarian (Georgia).

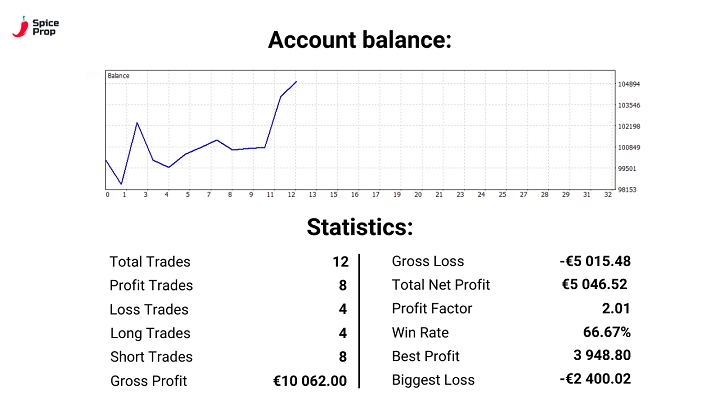

13/01/2025 - 28/01/2025

Etapa 1. Datos estadísticos. Sweet Pepper 100K. Trader: Giorgi Durgarian (Georgia).

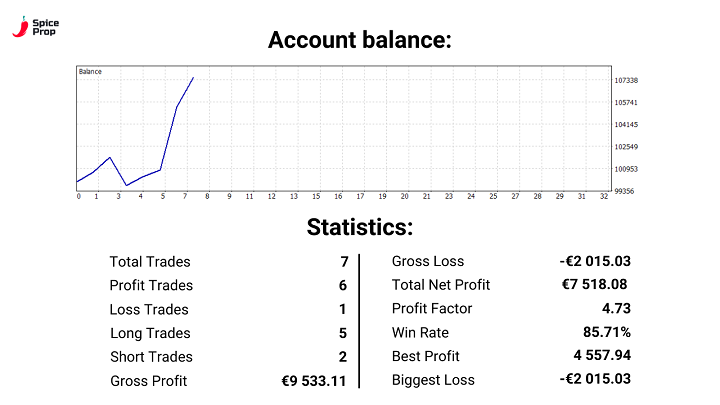

Etapa 2. Datos estadísticos. Sweet Pepper 100K. Trader: Giorgi Durgarian (Georgia).

13/02/2025 - 11/03/2025

Etapa 1. Datos estadísticos. Sweet Pepper 100K. Trader: Giorgi Durgarian (Georgia).

Etapa 2. Datos estadísticos. Sweet Pepper 100K. Trader: Giorgi Durgarian (Georgia).