Mohamed Ouarda: From Strategy to Success in Prop Trading at SpiceProp

06.06.2025

Пікірлер

It took Tunisian trader Mohamed Ouarda several months to complete the Sweet Pepper 10K Challenge. Well, such an experience deserves special respect. He has come a long way. Now Mohamed is a verified SpiceProp trader and is working on scaling his funded account. We asked him to share his thoughts on prop trading, his career journey, and the qualities that matter most in this business.

Why do you like trading with SpiceProp?

I enjoy trading with SpiceProp because of the company’s strong reputation for reliability and transparency. The platform provides a user-friendly interface, competitive spreads, and efficient customer support. I also value the wide range of trading instruments available, which allows me to diversify my strategies. Overall, I feel confident and supported when trading with SpiceProp.

What was the most important factor that helped you pass the SpiceProp Challenge?

The key to passing the SpiceProp Challenge was having a solid trading plan and sticking to it with discipline. I focused heavily on risk management, remained patient, and avoided emotional decisions. Staying consistent and composed during market fluctuations made a significant difference.

“The moment I stopped chasing profits and focused on managing risk—that’s when everything changed.”

Mohamed Ouarda on the turning point in his trading journey.

What was the turning point in your trading career?

The defining moment in my trading journey came when I shifted my focus from chasing profits to managing risk and preserving capital. This change in mindset helped me trade more consistently and professionally. It marked a turning point where I began to see real growth and increased confidence in my performance.

How long have you been trading?

I’ve been trading for about two years. During this time, I’ve experienced various market conditions, sharpened my risk management skills, and developed a disciplined approach to trading.

What does your trading plan look like?

My trading plan is built around three main pillars: risk management, strategy, and emotional control. I set clear risk-to-reward ratios and never risk more than a small percentage of my capital on any single trade. I rely on specific technical setups, such as trend-following strategies and support/resistance levels, to identify high-probability trades. I also review my trades regularly to analyse what worked and what didn’t, continuously refining my approach. Above all, I maintain emotional discipline—avoiding impulsive decisions and sticking to my plan, even during volatile market periods.

Phase 1. Statistical data. Sweet Pepper 10K. Trader: Mohamed Ouarda (Tunisia).

What three qualities helped you succeed in the SpiceProp Challenge?

Discipline. Patience. Focus.

What separates average traders from the best?

Discipline, emotional control, and consistency. The best traders stick to their strategies, manage risk meticulously, and don’t let emotions dictate their decisions. They treat trading like a business—always learning, adapting, and refining their edge.

“Protect your capital first; the profits will follow.”

The best piece of advice that helped Mohamed succeed in the SpiceProp Challenge.

What’s the best piece of advice that helped you during the SpiceProp Challenge?

The best advice I received was: “Protect your capital first; the profits will follow.” This reminded me to always prioritise risk management and avoid overtrading. Staying patient and waiting for high-probability setups helped me stay consistent and ultimately meet the challenge objectives.

Could you recommend any books, online resources, or people that influenced your trading development?

Absolutely. Several resources have been instrumental in my growth. Books like Trading in the Zone by Mark Douglas and The Daily Trading Coach by Brett Steenbarger helped me build mental discipline. I also follow online communities like BabyPips and learn from traders such as Rayner Teo and ICT (Inner Circle Trader), who provide valuable insights on market structure and strategy. These resources have helped me stay focused, improve my risk management, and develop a clear edge in the market.

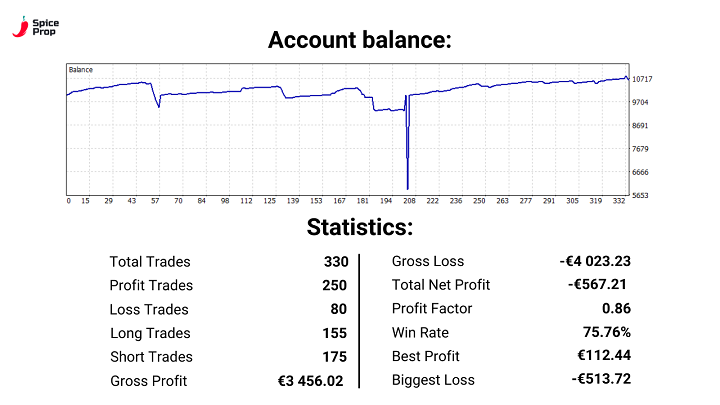

Phase 2. Statistical data. Sweet Pepper 10K. Trader: Mohamed Ouarda (Tunisia).

Should we learn more from ourselves or from others?

Both are vital. Learning from others allows us to avoid common mistakes and gain insights more quickly. But learning from our own experience—through wins and losses—is what truly cements that knowledge. The best traders strike a balance: they study others while also reflecting deeply on their own performance and progress.

Popular articles

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Service Update: Temporary Technical Issues

25.09.2025

Жаңалықтар

Жаңалықтар

Жаңалықтар

Back to Lab: Educational September Is On!

01.09.2025

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

SpiceProp June Shopping Festival is ON!

26.06.2025

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Пікірлер

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Пікірлер

Жаңалықтар

Бір, екі, үш... Ең керемет бустерлер осында!

25.03.2025

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Пікірлер

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Пікірлер

Дионисие Флореа: Трейдингтегі табысқа жету

13.01.2025

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Сұхбат

Жаңалықтар

Пікірлер

Риад Мазгу: €7 000-нан жоғары пайда табу

12.08.2024

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Сұхбат

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Жаңалықтар

Пікірлер

Жаңалықтар

Пікірлер

Жаңалықтар

Жаңалықтар

Жаңалықтар

Сұхбат

Жаңалықтар